Full Service End to End

Need to grow your business, while minimizing overhead? Using our best practices, methodologies and integrating technology, we make your bookkeeping a breeze.

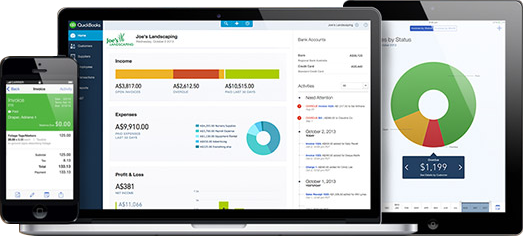

ONLINE SETUP

ONLINE SETUP

We customize Quickbooks Online, creating your chart of accounts, setting up your banking & credit card fees, customized based on your business.

Anywhere, Everywhere!

Empower your business with rich data and actionable insights.

Apps for Mobility

Your entire business, at your fingertips, everywhere you go.

Make better Decisions

Improved decision making through automated reports, accessible 24/7.

Transforming your financial

information into actionable data

WHY WE ARE DIFFERENT

There are three things you should know about bookkeeping, in the age of technology.

-

As a business owner, the books should be your friend.

This means that instead of treating bookkeeping as a cost that is unavoidable, and not really care how accurate or updated it is, a modern business manager should be able to use the tools available to help plan and grow the business. Having a real A/R number, a real A/P number that is accurate within 24 hours, including all credit card charges, allows one REAL data that allows ACCURATE decisions about the business. Cash flow projections are now meaningful, capital requirements become simple, and areas of the business that need attention become CLEAR.

-

As a business manager, you should spend 5 minutes a day on your books.

No more, but also no less

Key insights into your business performance are available through reports and you can quickly identify mistakes, anomalies, and areas that require your action. You should have a real bank balance number that is more accurate than the bank as it includes your float of checks sent out but not yet deposited. 5 minutes a day gives you enough time to have a good handle on what is going on, but your time is too valuable to dedicate more than this, the work should be done for you, accurately, timely, and smoothly. -

As a 21st Century business, technology should be utilized to the utmost

Most businesses run on one system, but the bookkeeping is done on another system. This may be necessary as the requirements of a particular business do not lend themselves to working only off an accounting software. However, we can bridge the systems to import the data into Quickbooks Online so a business can take advantage of all the powerful tools available in Quickbooks Online to help manage your business more efficiently. There are also many apps such as time cards, document management systems, and many others, that completely integrate into Quickbooks Online, which makes all of the functions of your business run better. Better payroll management and reports, better tracking of expenses, better visibility into outstanding A/R and better understanding of a firm’s financial position.

-

Give Us A Call

1-844 Powered

or