Actionable Data. Accurate. On Time.

Our Pledge: Not more than 5 minutes of your day

Will be spent on your bookkeeping, we will do it all. A/R, A/P, Payroll, Bank reconciliation, Credit Card reconciliation.

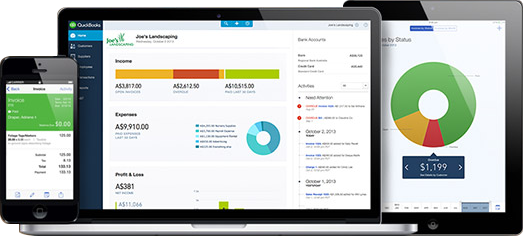

Free conversion to Quickbooks Online

Full Service, includes free Quickbooks Online setup and conversion including document management system and mobile apps.

Need help with your Books? All our bookkeepers are Certified Quickbooks Pro Advisors!

Our Pledge: Not more than 5 minutes of your day

We will even pay bills on your behalf and follow up on your open A/R. Reduce your overhead and increase your cash flow

Full Service, including Quickbooks Online setup and conversion including document management system and mobile apps.

Get Meaningful Insights of your Business

Our Pledge: Not more than 5 minutes of your day

We will integrate popular productivity apps into your Quickbooks Online account and help you use technology. Check out our app reviews and get your business mobile

Full Service, including Quickbooks Online setup and conversion including document management system and mobile apps.

Full Service End to End

Need to grow your business, while minimizing overhead? Using our best practices, methodologies and integrating technology, we make your bookkeeping a breeze.

Accounts Payable

Keep track of expenses, due dates, and ensure accuracy

Accounts Receivable (+ Follow Up)

Track all your income in QuickBooks Online and timely follow-up on money you are owed

Bank Reconciliation

Keep your QuickBooks Online matched to your bank statements to manage your cash flow, keeping your books audit ready

Credit Card Reconciliation

Import credit card charges into Quickbooks Online to track expenses, keep them within budget, and reconcile to your bank account

Payroll Management

Calculating hours, overtime, sick pay & holiday pay, and submitting it to your payroll company

Apps for Mobility

Tools for efficiency via apps integrated into Quickbooks Online like time sheets, AR, CRM and more

Expense & Document Management

Project expenses & cash flow in advance for better business management at your fingers

Benchmarking

Gauge your financial performance against prevalent industry norms make sure you are not paying too much for things like credit card processing, or bank fees

Bookkeeping Catch-up Projects

We specialize in fixing and cleaning your books

ONLINE SETUP

We customize Quickbooks Online, creating your chart of accounts, setting up your banking & credit card fees, customized based on your business.

Anywhere, Everywhere!

Empower your business with rich data and actionable insights.

Apps for Mobility

Your entire business, at your fingertips, everywhere you go.

Make better Decisions

Improved decision making through automated reports, accessible 24/7.

Transforming your financial information into actionable data

On average, PoweredBooks clients save up to 70% versus in house bookkeeping

WHY WE ARE DIFFERENT

There are three things you should know about bookkeeping, in the age of technology.

As a business owner, the books should be your friend.

This means that instead of treating bookkeeping as a cost that is unavoidable, and not really care how accurate or updated it is, a modern business manager should be able to use the tools available to help plan and grow the business. Having a real A/R number, a real A/P number that is accurate within 24 hours, including all credit card charges, allows one REAL data that allows ACCURATE decisions about the business. Cash flow projections are now meaningful, capital requirements become simple, and areas of the business that need attention become CLEAR.

As a business manager, you should spend 5 minutes a day on your books.

No more, but also no less

Key insights into your business performance are available through reports and you can quickly identify mistakes, anomalies, and areas that require your action. You should have a real bank balance number that is more accurate than the bank as it includes your float of checks sent out but not yet deposited. 5 minutes a day gives you enough time to have a good handle on what is going on, but your time is too valuable to dedicate more than this, the work should be done for you, accurately, timely, and smoothly.

As a 21st Century business, technology should be utilized to the utmost

Most businesses run on one system, but the bookkeeping is done on another system. This may be necessary as the requirements of a particular business do not lend themselves to working only off an accounting software. However, we can bridge the systems to import the data into Quickbooks Online so a business can take advantage of all the powerful tools available in Quickbooks Online to help manage your business more efficiently. There are also many apps such as time cards, document management systems, and many others, that completely integrate into Quickbooks Online, which makes all of the functions of your business run better. Better payroll management and reports, better tracking of expenses, better visibility into outstanding A/R and better understanding of a firm’s financial position.

Give Us A call

1-844 Powered

Service plans starting at just

$99.99/Month

Areas We Serve

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming