Bill.com

Magically Simple Business Payments

About

Bill.com helps you automate your payables and receivables online. It’s an all in one that helps you route bills for approval, store and share documents, send invoices via email or mail, pay and get paid, charge customers via ACH or credit card. This app integrates and syncs with QuickBooks Online flawlessly.

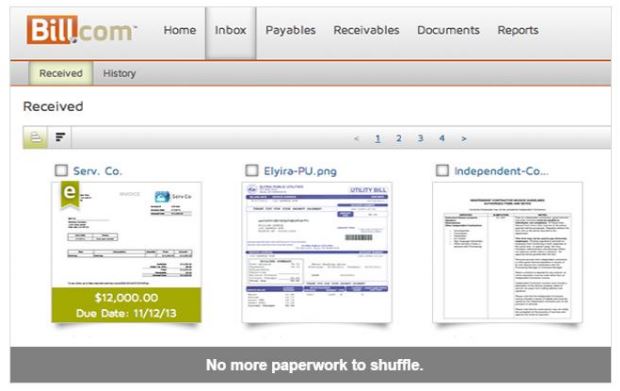

All you have to do is scan, fax or email your bills, contracts and other documents to Bill.com, then shred the paper. Then you log into Bill.com, any new bills will appear in your inbox. From there you can create a new bill or a vendor credit, add a payment received, and add a new vendor and a lot more.

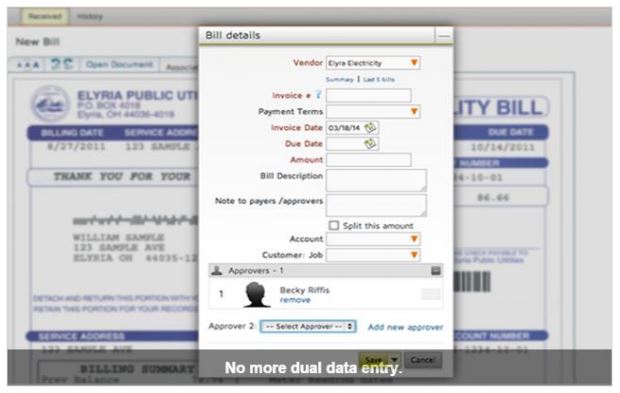

For each new bill, all you would have to do is simply type the first few letters of the vendor’s name. If the vendor has been paid, some fields will fill in automatically. Next step, code the bill to the right account, add any approvers, and save it at the click of a button. Once that is done Bill.com notifies the approvers by email. Now your approvers can okay bills from anywhere. If they need to check a contract, it’s at their fingertips even from their phones. Yet everyone sees only the information they need online to do their part.

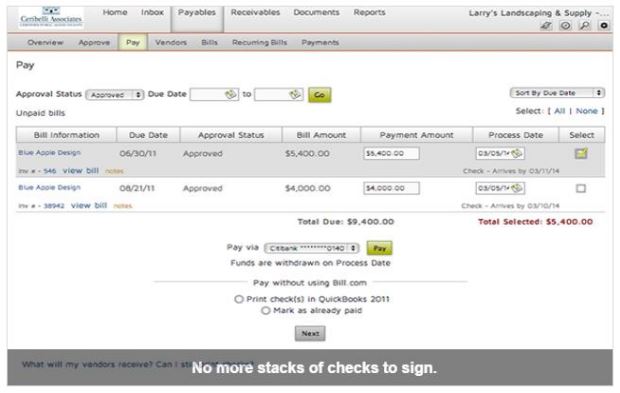

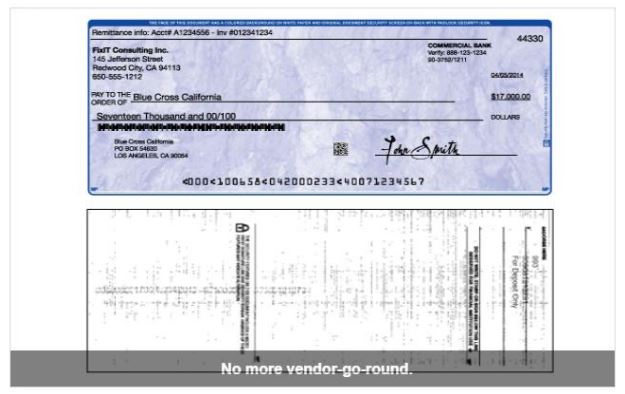

Now you can pay bills from anywhere. Simply select bills to pay from the approved list, and choose the dates for payment. Bill.com prints and mails the checks for you, or pays electronically the choice is all yours. Once the bill is paid, Bill.com automatically syncs it to QuickBooks Online.

Pricing

Starting at $29/user/month. 30 day risk free trial.

| Plan | Price | Users | Details |

|---|---|---|---|

| Team | $29/user/month | 1 |

|

Support

Email: support@bill.com

Phone Support: (877) 345-2455

Online: https://support.bill.com/hc/en-us

Reviews

Pros of Bill.com

The underlying product of Bill.com, security and concept are one of the best available in the market. Bill.com can become the core part of your accounting solution, with the Documentation Management System built in and the e-payment features are reason enough to use it.

This accounts payable/receivable system integrates seamlessly with QuickBooks Online. It has a sync function that allows you to bring across all your data into QuickBooks Online. Bill.com has just about every permutation and combination of how you can pay and how you can collect that has ever been imagined. The other point to keep in mind is that integrating bill.com can extend the functionality of QuickBooks Online to a substantially larger business before there is a need to step up to a real accounting package.

With Bill.com we no longer have to physically travel to a client’s office, load checks, and find an authorized signatory. Bills get paid faster and with more oversight. Users were resistant at first, fearing a lack of attention being paid to data entry and approvals (which is honestly still a concern) but the remote access, audit trail and visibility to all users mitigates a great deal.

Cons of Bill.com

The user interface is a little sober and it could have been a lot more intuitive. We also felt that the accountant does not have to pay $50 for the client dashboard, which should be provided free of cost maybe if the accountant has 5 or more clients using the Bill.com platform.

During our research and testing Bill.com we found that it leaves a lot to be desired with its sync function with QuickBooks Online. We still had to manually update information after sync and it did not properly handle markups on client invoices. This issue can cause serious trouble because future syncs with Bill.com can remove the markup % on an invoice after the client has been billed.

Overall, a great product getting better all the time.